Recently, in a crowded conference room in Melville packed with developers, business leaders, municipal officials and other interested parties, the Rauch Foundation unveiled its latest Long Island Index report.

The principal finding of their effort, titled Long Island’s Needs for Multifamily Housing: Measuring How Much We Are Planning to Build vs. How Much We Need for Long Island’s Future, is that we will have a deficit of 72,000 housing units in “walkable mixed-use areas” by 2030. The research was conducted by the Regional Plan Association and HR&A Advisors, both groups based in Manhattan.

To this writer, the reception seemed less enthusiastic than in previous years, when the Rauch Foundation’s Long Island Index exhaustively detailed the region’s environmental, transit and housing challenges. Perhaps this report’s numbers-heavy findings were too much for those in attendance to digest.

The Index’s recommendations depend on supply driven housing economics. But their consultants’ analysis may not reflect the reality of Long Island’s suburban landscape, or what truly drives up housing costs here. For their solution to work, a lot depends on local zoning boards approving higher density.

During the presentation, one of the PowerPoints predicted that the increased supply will make housing more affordable, “assuming all new value created through rezoning is passed down to tenants through a reduction of rents.” But that’s no small assumption.

Did the creation of additional units in Queens, Brooklyn or Manhattan make any of those boroughs more affordable? Nobody would make that premise about New York City because they know better.

As the report outlines, is Long Island supposed to rezone large swaths of land to allow for 2,582 additional units in Hicksville, 377 additional units in the Village of Babylon, and 962 units within the Village of Valley Stream based on the mere assumption that the “value created” will trickle down to tenants? Did the addition of multifamily units make rents in Patchogue, the long-held bastion of smart growth, more affordable? At $1,992 a month for a 679-square foot, one bedroom apartment in New Village at Patchogue, no. Did the addition of units in Mineola make the already attractive area any more affordable? If $2,236-a-month-rent for a 486-square foot studio at Mill Creek’s Modera is any indication, no.

The Long Island Index’s report is out of whack considering the realities of housing within the region—and how really affordable housing is typically created.

In the more realistic scenario, public-private partnerships use tax subsidies to create affordable housing units. Private market developers produce units at differing price points to maximize profitability for their investors. Unless the proposed units are slated to be heavily subsidized, it is very likely that the residents in these areas are essentially being urged to relax their zoning density restrictions in order to maximize the profits of developers. When it comes to housing, trusting private development interests to create truly affordable housing is like letting the foxes watch the hen house.

For years, the Rauch Foundation has been the leader in depicting the Island’s problems and proceeding to present philosophical solutions that are easy to understand, but sometimes fantastical in nature. The key to the Long Island Index’s success is that it takes rather unsexy topics and packages them in a colorful, presentable manner—with some years having cutesy videos that outline Long Island’s economic stagnation. Great marketing and public outreach, yes, but those are weak fires in which to forge policy. This recent presentation was less flash and more numbers.

In this instance, the big picture is so disconnected from the on-the-ground realities that the final product almost seems disingenuous. The Long Island Index’s goal of increasing density to foster more walkability and transit usage is laudable, but the pesky issue of actual commuting patterns gets in the way of the convenient, builder-driven narrative that has been fostered in Nassau and Suffolk counties.

According to estimates from the U.S. Census Bureau’s 2013 American Community Survey, 88 percent of Suffolk County’s workforce uses automobiles to travel to work, with about 6 percent of workers taking transit, and 10 percent of Suffolk’s workforce heading to NYC for employment. There is little hope in creating the vibrant urbanized oases that they want. In Nassau, 77 percent of workers drive their cars to and from work and 16 percent of workers take mass transit. Maybe the prospects are better there. Plus, the presence of sewers makes development easier the more westerly you go. But even in Hicksville, as the report shows, the matter gets complicated due to private land ownership, zoning restrictions and what is often little discussed: the capacity of our infrastructure.

One issue that the Long Island Index and its pro-builder cohort seems to neglect is the viability of integrating these downtown environments within a larger, cohesive environment. As it stands, the Index is all for the creation of these artificial downtown environments without understanding their inherent isolation. Urban enclaves need to be interconnected in order to thrive. Think how the diverse neighborhoods of Manhattan’s Lower East Side merge into one another seamlessly. Downtown Patchogue and Mineola don’t blend in easily with their surroundings. These revitalized areas are essentially apartment buildings scattered within single-family-home neighborhoods.

Overall, the latest Long Island Index report repeats the same mantra that has been echoed from various conference rooms, board rooms, panels, and podiums at business breakfasts at the Crest Hollow Country Club and beyond: Build! Build! Build!

But to do so without taking into account the fundamental realities of Long Island’s housing market, our economy, our environmental limitations, and what our residents actually do on their daily commute, may work on paper, but it becomes a harmful prospect when it’s seriously being considered to direct policy.

We need a diverse group of stakeholders who think critically and constructively about our regional issues, not vested interests who always agree.

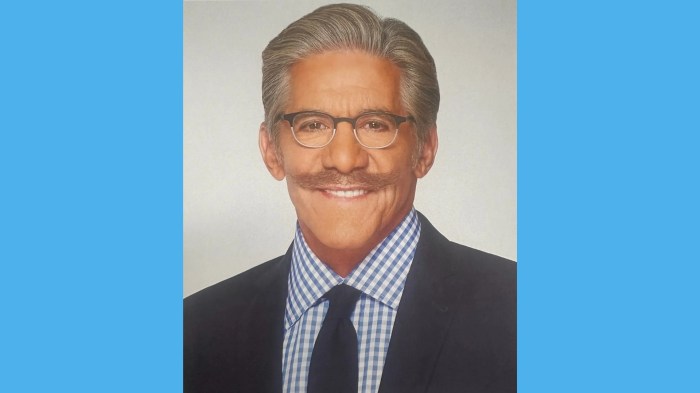

Rich Murdocco writes about Long Island’s land use and real estate development issues. He received his Master’s in Public Policy at Stony Brook University, where he studied regional planning under Dr. Lee Koppelman, Long Island’s veteran master planner. Murdocco is a regular contributor to the Long Island Press. More of his views can be found on www.TheFoggiestIdea.org or follow him on Twitter @TheFoggiestIdea.