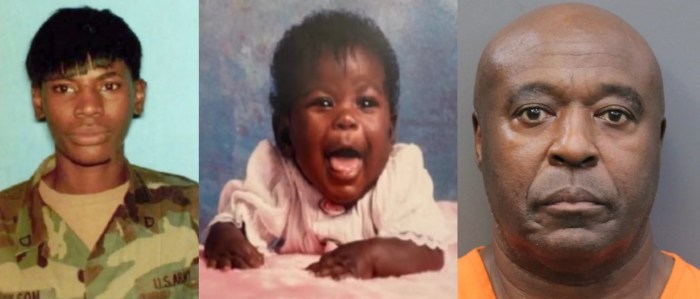

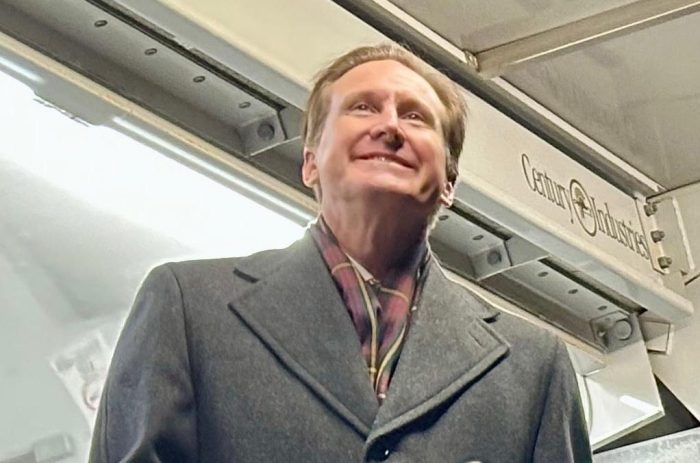

Assemb. Joseph Saladino (R-Massapequa) was appointed Tuesday as the new Town of Oyster Bay supervisor to replace his longtime predecessor who resigned this month after being arrested on federal corruption charges.

The board voted 5-0 with one abstention during a special board meeting to give Saladino the job ex-Oyster Bay Town Supervisor John Venditto had held for two decades before he stepped down to focus on his defense.

“I will work to gain the faith and trust of our residents, by providing transparency and improving efficiency, as well as looking to provide affordability and fiscal integrity,” Saladino said. “We will make Town government live within its means, while continuing to deliver top notch municipal services, the kind of services Town of Oyster Bay residents have come to expect.”

Venditto resigned Jan. 4. after he pleaded not guilty in October to an alleged kickback scheme. Venditto held out for more than two months before relinquishing his seat.

Saladino has served as assemblyman for the southeastern corner of Nassau County and southwestern corner of Suffolk County since 2004.

The veteran assemblyman takes the reins of a town that has been beset by fiscal woes and whose former supervisor became the focus of a federal corruption probe that extended to the county seat.

Venditto, along with Nassau County Executive Ed Mangano and his wife, Linda, was charged in an alleged bribery scheme. Authorities alleged that Mangano and Venditto conspired to back loans and award contracts to a businessman in exchange for kickbacks. Linda allegedly received a $450,000 no-show job. Ed and Linda also pleaded not guilty.

On the morning of their arrest, a handful of Republican New York State Senators called on both Mangano and Venditto to resign. Mangano steadfastly refused, while Venditto was more ambiguous about his intentions until Venditto released a statement announcing his resignation earlier this month.

The turmoil in Oyster Bay is not exclusive to Venditto’s corruption probe. The former supervisor was at the helm when Moody’s Investors Service last year withdrew its credit rating for failing to provide a previous year’s audited financial statement. Last week, Moody’s assigned a Baa3 rating to the town’s $29.45 million in general obligation bonds, citing the town’s “weak fund balance and cash position following years of structural imbalance, a sizeable and diverse tax base, and an average debt burden with elevated fixed costs.”

It now falls on Saladino to pick up the pieces.