Rep. Peter King (R-Seaford) has been the most vocal opponent of tax reform legislation that passed the U.S. House of Representatives last week. And as the House geared up for the vote, King defended New York from a major player in the debate, someone whom King claims is “[taking] shots” at the Empire State.

At the heart of the debate has been the proposed elimination of the state and local income tax deduction. That deduction, which has been in place since 1913 took another step towards extinction as the House voted 227 to 205 to approve the “Tax Cuts and Jobs Act” tax reform bill. The legislation now goes to the United States Senate, a body that also supports the deduction elimination.

The House vote didn’t happen without fireworks. Prior to it, King lashed out at Mick Mulvaney, director of the Office of Management and Budget (OMB) and himself a former congressman from South Carolina. “From Sandy aid to tax reform @MickMulvaneyOMB tries to screw New York,” King wrote on his Twitter account. “[He] probably feels inferior because New York subsidizes his state of South Carolina.” Earlier, King maintained that Mulvaney “seems to use every opportunity to take shots at New York,” noting the former congressman’s opposition to Hurricane Sandy relief funding and the 9/11 health care bill.

Those comments were a response to remarks Mulvaney gave to journalists when he claimed that state taxes—and not whatever the federal government does—are “driving people out of [New York.]”

“I don’t think it’s up to the federal government to save New York from its bad decisions,” Mulvaney said.

That prompted a response from not only King, but also Gov. Andrew Cuomo, who issued a terse statement: “I’ll make it simple: Just give New York the $48 billion we send to Washington that makes us the number 1 donor state in the nation and he and the president can do whatever they want with state and local tax deductibility.”

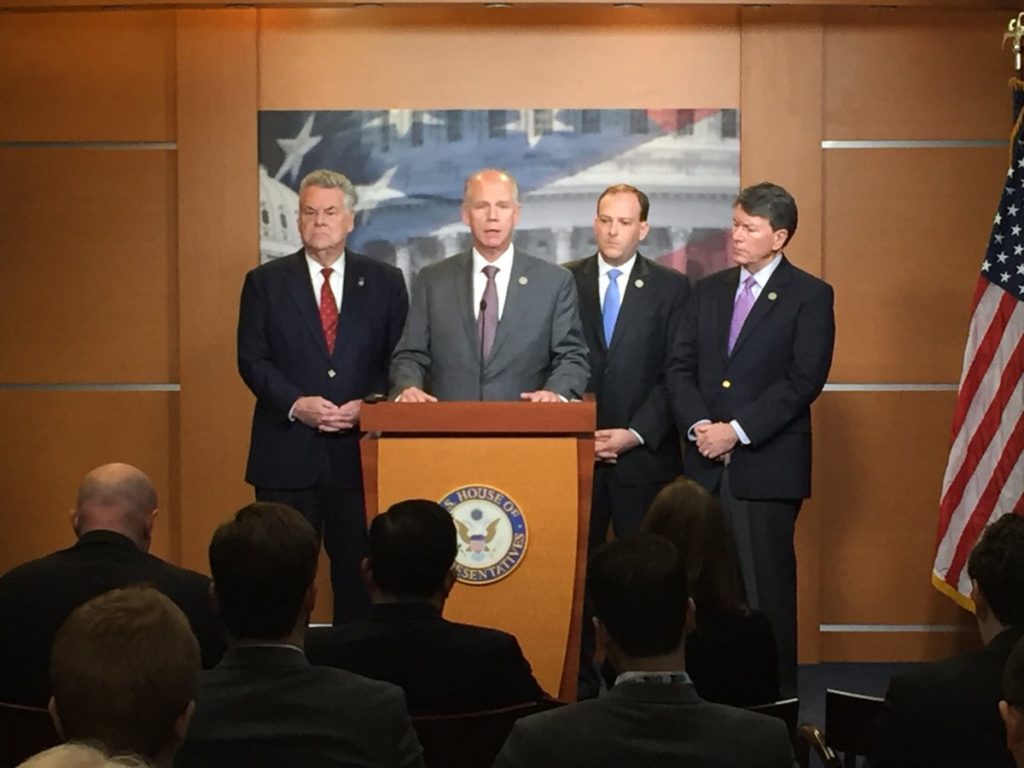

The vote was mostly along party lines. Thirteen Republicans bucked party leadership to oppose the bill. That included five Republicans from New York: King, Lee Zeldin, Daniel Donovan, Elsie Stefanik and John Faso. None of the 194 Democrats voted “yes.”

The votes were no surprise. King and Zeldin, both of whom have Long Island-based districts, have long made it clear that they could not vote for a bill that eliminates the deduction. This week, both King and Rep. Thomas R. Suozzi (D-Glen Cove) co-authored a letter criticizing the bill. (Click here to read the letter.)

Following the vote, Suozzi delivered his own scathing statement, calling on New Yorkers to withhold any contributions they might make to the Republican Party and to “any Republican organization or candidate that supports the elimination of the state and local tax deduction as proposed in the Republican tax plan.”

“New Yorkers must unite,” Suozzi declared. “Anyone who cares about our state needs to work together and send a message that we won’t allow New Yorkers to be taken advantage of. Let’s stand together and say, ‘enough is enough’….anyone that supports getting rid of the state and local tax deduction does not have the true interests of New York at heart and should not be rewarded for their betrayal of New York’s middle-class families.” Suozzi also noted opposition to the bill by The U.S. Conference of Catholic Bishops.

The bill does allow for a property tax deduction of up to $10,000. That is a departure from legislation being considered in the U.S. Senate, which would eliminate not just the state and local tax deduction, but also the property tax write-off. Rep. Kevin Brady (R-TX), chairman of the House Ways and Means Committee, has insisted that the property tax deduction must be part of any final piece of legislation. Keeping that deduction probably did win over some lawmakers from California, New Jersey and New York, states where most of the opposition to the deduction elimination has come from.