You’ve likely heard the sobering statistic: About 70 percent of people 65 and older will need long-term care.

The price tag is just as frightening. Typical monthly costs on Long Island for an assisted living facility are $4,000; a semi-private room with nursing home care, $13,535; and for a private room with nursing care, $14,220, according to Genworth’s 2017 Cost of Care Survey.

So how do you pay for care? A long-term care insurance policy is one strategy. This provides income if you become dependent on someone else’s care or require assistance for basic living tasks and needs due to a chronic or prolonged illness, degenerative disease, or other condition that necessitates care at home or in an assisted living or long-term care facility.

Policies don’t come cheap, especially if you wait until your 50s or older to buy one. They can run a few thousand dollars a year.

“I continue to hear that long-term care insurance is expensive, but compared to what?” says Brett Anderson, president of St. Croix Advisors in Hudson, Wisconsin. “If you need ongoing care, you could easily spend $8,000, $10,000, $15,000 a month. I don’t see LTC insurance as expense, I see it as pre-paying in the event you need extended care, and you want to protect your loved ones and your assets by transferring some or all the risk to an insurance company.”

EXPLORE SELF-INSURANCE

The reality is, rising premiums are too expensive for middle-income Americans, says Lingke Wang, co-founder of Ovid Life in San Francisco. For many, self-insuring is their best solution.

What does that mean? You save enough to cover your own long-term care expenses. There are advantages.

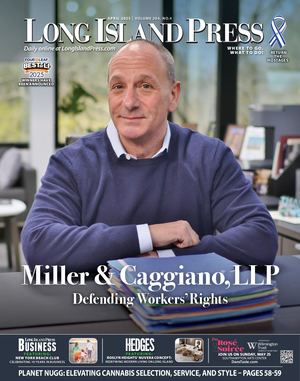

“You have more choices,” says Matthew Rappaport, counsel with the law firm of Sahn Ward Coschignano in Uniondale. “You can go to a high-level facility or choose to pay a family member to administer care in any setting. Government-funded long-term care typically is more restrictive. I wouldn’t want to be left with only the choices Medicaid provides me.”

Secondarily, going through the insurance process spurs people to address related needs such as estate planning, financial planning, and retirement spending projections, he says.

One way to self-insure is with whole life insurance that builds usable cash values and has a long-term care rider.

“It’s often less expensive and a much richer and all-encompassing way to get the benefits of long-term care, along with a death benefit and the potential to build cash,” says Michele Lee Fine, financial representative with Guardian Life Insurance in Jericho.

STRATEGIES FOR SUCCESS

“Self-insuring is typically not done with accuracy or with any real ability to solve the equation,” says Lou Cannataro, partner, Cannataro Park Avenue Financial in Manhattan. “Quite often, it just seems to be the better alternative than spending significant dollars insuring against something that may not occur. Most do not realize the amount of money that can be lost to a long-term care need.”

His plan: “Build out your planning retirement model factoring in all of your goals and monetary needs through your life span,” he says.

If there is a shortage you cannot afford to self-insure. If your planning shows you can retire and not run out of money, you’re in good shape.

“Layer into this planning a long-term care need,” he adds. “If your goals are still accomplished even with the cash flow out for care, you can self-insure.”

WHAT’S A GOOD RULE OF THUMB?

“If you have at least $250,000 in current dollars to be inflated each year by 5 percent to spend on each occurrence of care in the future, plus all your other retirement assets to accomplish your goals, you can likely self-insure,” says Cannataro.

Have a written game plan for reducing debt. Free up income to invest in retirement and self-insure. Put in place an emergency fund of at least three to six months, a year if you’re older.

“Don’t put all your money in a retirement fund which is not accessible before you’re 59 1/2 and have no emergency fund,” says Kalen Omo, owner of Kalen Omo Financial Coaching in Tucson. “This could come back to haunt you if an unexpected event forces you to dip into retirement sooner than you would like to.”