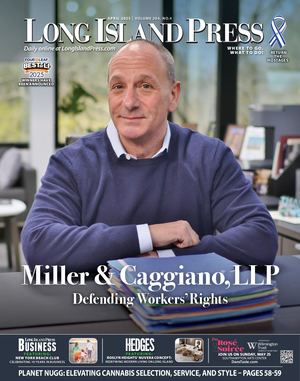

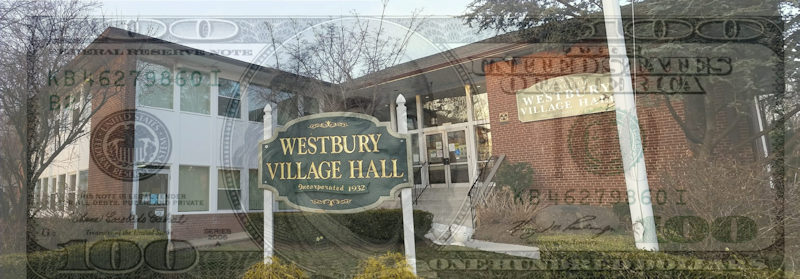

Westbury praised for its fiscal management

Westbury praised for its fiscal management

Once a year since 2010—with the exception of 2011—the Village of Westbury has issued public improvement serial bonds, mainly to finance the upkeep and repaving of its roadways, one of the highest municipal expenses. Last year, the village issued $1.25 million in bonds.

The borrowing on the bond market has been relatively cheap for the village, thanks to its high ratings by two of the major global municipal bond credit rating services. Mayor Peter Cavallaro touted a Jan. 27 report by Moody’s Investor Services that gave the village a bond rating of Aa2, “which along with the AA+ rating ascribed by Standard & Poor’s Global Ratings are the highest bond ratings in the village’s history,” according to the mayor.

Moody’s Aa2 score is part of what it calls it Prime-1 category and is topped only by Aaa and Aa1. According to its definitions, Aa2 indicates that the obligations “are judged to be of high quality and are subject to very low credit risks.”

The mayor picked out the following highlights in Moody’s ratings report:

• “The credit position of Westbury is very strong and its Aa2 rating slightly exceeds the median rating of Aa3 for cities nationwide.”

• “Key credit factors include a robust financial position, strong wealth and income profile and sizable tax base. We do not see any material immediate credit risk for Westbury.”

• “The rating also reflects a negligible debt burden, and moderate pension liability.”

• “Overall, Westbury has a very healthy economy and tax base”

The report also praised “Westbury’s cash balance as a percent of operating revenues (44 percent)…and fund balance as a percent of operating revenues (42.6 percent).”

“Does it make a difference if you were one bond rating below that?” Cavallaro was asked by the Westbury Times.

“It makes a difference,” he replied. “We’re in an historically low-interest environment. The impact of a bond rating is probably bigger in an environment where the rates are higher. [Trustee] Beaumont [Jefferson] can speak to the fact that your bond rating directly affects the borrowing rates that you receive, and even though in this environment you’re not saving as much, you are saving money, and when the interest rate [go] higher you’ll save even more.”

The bond rating also determines those willing to buy the bonds, the mayor noted, adding, “Some bond buyers only buy at certain ratings. So the bigger the pool of people who are willing to buy your bonds, the better. It’s really a competitive auction.”

Jefferson, the Nassau County treasurer, observed, “The rating is going to determine the attractiveness of the bond. Even when rates are historically low, you’ll still have savings.”

Cavallaro said the village never has any problems selling its bonds, and many times they are bought by the same buyer.

“The last rating change was a couple of years ago,” the mayor stated. “The only [Standard & Poor’s] rating above us is AAA, and the main constraint against us getting AAA is the size of the municipality. If we were a bigger municipality we’d probably stand a better chance of us getting it. It’s the second highest possible rating, and the highest we’ve ever had. We’re comfortable at that level.”

“You’re borrowing money at almost no costs,” he said of the low interest rates imposed by the Federal Reserve. “And we’re replacing debt all along that was borrowed at a much higher cost. Our principal and interests have been reduced. We’re replacing higher interest debt with lower interest debt. The credit report said our debt load is extremely low. So even though we borrow on a regular basis, it’s not an overwhelming amount of debt that we maintain.”

“The rating confirms that our past conservative budgeting and fiscal discipline has positioned Westbury to weather the current economic downturn and that our strong management practices have resulted in an exceptionally strong financial position,” Cavallaro said in a statement. “That affirmation should give our taxpayers comfort that this highly respected third party recognizes the village for prudent financial management and stewardship of their tax dollars. Our ability to maintain the village’s strong finances in this difficult economic period proves that prudent, conservative budgeting and finance practices make a real difference for taxpayers.”

The village has never breached the state-imposed 2 percent tax cap, introduced with the 2011 fiscal year. With some limitations, it limits the tax levy—the amount a municipality raises via property taxes—to 2 percent or the rate of inflation. For the 2020-21 fiscal year, which began on July 1, Westbury’s tax cap is 3.08 percent, which includes a permitted carry-over from the previous year.

In his budget message, Cavallaro noted that the village has a residential tax rate of .00224, meaning that a property owner with a median house value of $464,300 (per the federal government data) will pay about $1,040 annually in village taxes.

Unlike the county, which depends on sales taxes for about 40 percent of its revenue, villages and towns rely more on property taxes, and therefore have not been impacted as greatly by the pandemic economic slowdown.

“The current economic environment is very challenging,” Cavallaro concluded, “but we are hopeful that this re-affirmation of the village’s financial condition and stewardship gives our residents and business owners, as well as those looking to do business or live here, the comfort of knowing that the village continues to be among the most fiscally strong and well-managed municipalities on Long Island, and that Westbury will continued to be an economically attractive place to live, work and do business, even at this distressed time.”

According to the Moody’s report, “We regard the coronavirus outbreak as a social risk under our environmental, social and governance framework, given the substantial implications for public health and safety and the economy. We do not see any material immediate credit risks for Westbury. However, the situation surrounding coronavirus is rapidly evolving and the longer term impact will depend on both the severity and duration of the crisis. If our view of the credit quality of Westbury changes, we will update our opinion at that time.”

Paving the Way

“All of the borrowing has been for road improvements?” Cavallaro was asked.

“Mostly for road work. I would say 90 percent of what we borrowed over the past 10 years was for roads. I think a couple of years we did buy a truck,” Cavallaro replied. “The last 8 to 10 years, we made a conscious effort to pave our roads.”

“When do you expect the final roads to be paved?” the mayor was asked.

“Never. Once you finish you have to start all over again,” he replied. “I think we have another year and a small stub piece to finish. I think in the next year, all of the residential streets are going to be completed.”

The primary north-south village-owned streets, Ellison Avenue, School Street and Powells Lane, have had many of their sections redone, Cavallaro said, adding, “Once we finish those north-south roads we’ll be done. And then, of course, the process begins again.”