Tired of paying extra for taxes and thinking about relocating to a no-tax state like Florida, Nevada, Tennessee, or Texas? A new webinar will help you gather all the necessary information you need to take that next step.

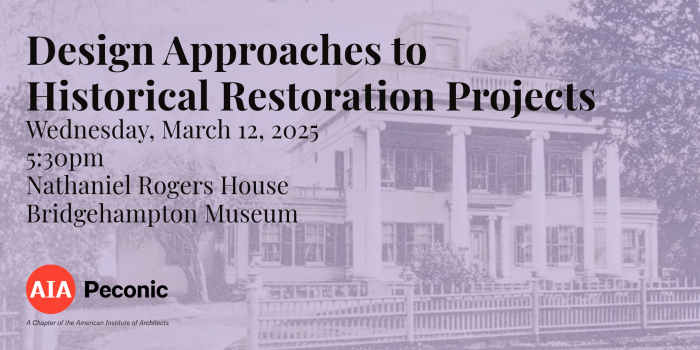

Schneps Media, the parent company of Long Island Press, will host a new webinar, “Leaving NY and Saving Taxes,” on June 9 at 11 a.m.

New York State has become very aggressive with its residency income tax audits. In 2018, 55 percent of taxpayers who were audited owed an average of $273,000 in back taxes. The state has more than 300 auditors and high-tech methods to track you. But who is advocating for you?

This webinar will cover what you really need for your residency audit, preparing for your residency tax audit, developing a tax strategy for business owners, and creating your domicile change playbook.

Experts will speak on this topic during the webinar, including Karen J. Tenenbaum, Esq., LL.M. (Taxation), a CPA and tax attorney with Tenenbaum Law, P.C.; Andy Presti, Managing Partner of Presti & Naegele; and Eric Donner ChFC, CExPTM, CAP, CLU, cofounder of Six Months and A Day, LLC.

Join these speakers for this “not to be missed” webinar!

Register here for “ Leaving NY and Saving Taxes.”

To view more webinars, visit SchnepsMedia.com/webinars.

Sign up for Long Island Press’ email newsletters here. Sign up for home delivery of Long Island Press here. Sign up for discounts by becoming a Long Island Press community partner here.