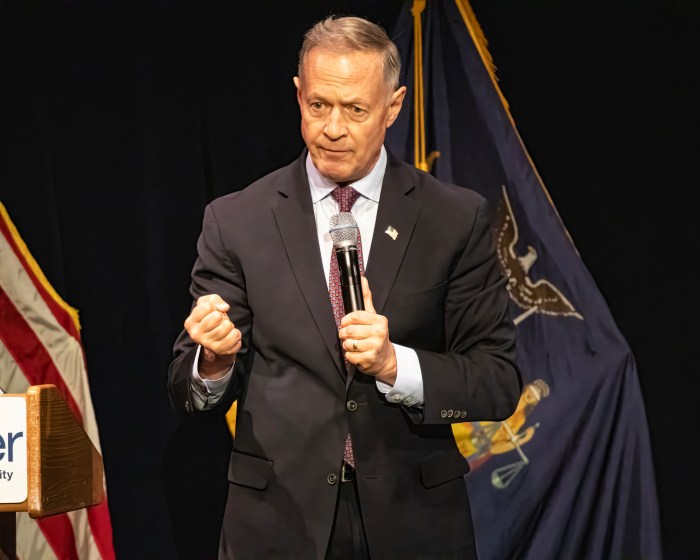

U.S. Rep. Tom Suozzi (D-Glen Cove) reiterated on Sept. 27 that he won’t support President Biden’s massive $3.5 trillion tax-and-spend reconciliation package unless there is full reinstatement of the State and Local Tax (SALT) deduction.

SALT has been a particularly sticky detail ever since former President Donald Trump rolled back the SALT deduction that allows residents of heavily taxed blue states such as New York and California to deduct any state taxes over $10,000 from their federal taxes.

Suozzi has previously insisted that he would not vote to approve the $3.5 trillion package – which includes massive spending increases on healthcare, education, fighting climate change and more – unless SALT is fully reinstated.

In a conference call with reporters, Suozzi refused to budge on his position when asked about reports that Congressional Democrats were looking to suspend the SALT cap of $10,000 for just two years.

“I’m going to continue my negotiations with everybody, and I’m pushing for a full repeal,” said Suozzi.

In 2019, the congressman had some success in passing a reversal of the SALT deduction cap. It passed in the House of Representatives, but not the Senate. This time around, Suozzi says he has more leverage to get it done, and wants to vote on Thursday without any delays.

“If you want to change the tax code, I’m fine, I’ll support that, but you’re not getting my vote … unless it includes [SALT],” Suozzi said.

He also said that they won’t get the votes of his fellow SALT supporters either. During President Joe Biden’s first attempts to relieve the country from its pandemic economic downturn, Suozzi and 10 members of the House Committee on Ways & Means sent a letter to the president that their future support depends on repealing the SALT cap.

While there is bipartisan support for the measure, there is also discord on both sides.“It’s hypersensitive, in many of their districts,” Suozzi said of his Republican colleagues.

Democratic U.S. Rep. Alexandria Ocasio-Cortez (D-Queens/Bronx) has publicly bashed the tax deduction, but recently admitted she’s open to discussing increasing the cap. Clearly in line with a “tax the rich” agenda, she has called SALT a “giveaway to the rich.”

When asked about SALT’s potential to give more advantage to the wealthy at the federal level, Suozzi said he has no problem with taxing wealthy people and that there are several other initiatives that do this — not the SALT deduction.

“Because we’re raising the top rate, because we are putting a 3% surcharge on people [who] make over $5 million a year, because we are raising the capital gains rate,” he said.

The $3.5 trillion plan needs unanimous Democratic support in the evenly-divided Senate to pass and can only afford to lose three Democratic House votes to pass, as Republicans have called the plan a non-starter.

This story first appeared on amNY.com.

Sign up for Long Island Press’ email newsletters here. Sign up for home delivery of Long Island Press here. Sign up for discounts by becoming a Long Island Press community partner here.