Flagstar Bank is laying off 1,900 people and taking a $20 million hit — but just two years ago, it was experiencing more financial success than ever. Here’s a closer look at what exactly happened to the Long Island bank.

Hicksville-based New York Community Bancorp, parent of Flagstar Bank, is laying off 700, selling operations that employ another 1,200 and taking a $20 million hit in the latest chapter of one of the region’s biggest and oldest banks.

While NYCB was never well known nationally, it grew consistently for decades, acquiring smaller banks, including troubled financial institutions, and rebranding branches as Flagstar Bank.

The more-than-400-branch bank, which is also rebranding the company as Flagstar Financial, has now taken a hit as it faces its own financial troubles, after last year acquiring $38.4 billion in assets from failed Signature Bank in a $2.7 billion deal.

Facing pressures on commercial loans and integrating acquisitions, Flagstar has been restructuring and changing leadership, as well as selling some assets.

Flagstar in SEC filings said it’s taking a $20 million charge related to 700 layoffs, with another 1,200 related to the sale of certain operations. That also comes after many depositors withdrew funds from the institution, where up to $250,000 is FDIC insured.

The layoffs include about 700 employees, or 8% of its workforce, as well as employees related to the sale of its mortgage servicing and third-party origination business to Mr. Cooper in the fourth quarter of this year, impacting 1,200 people.

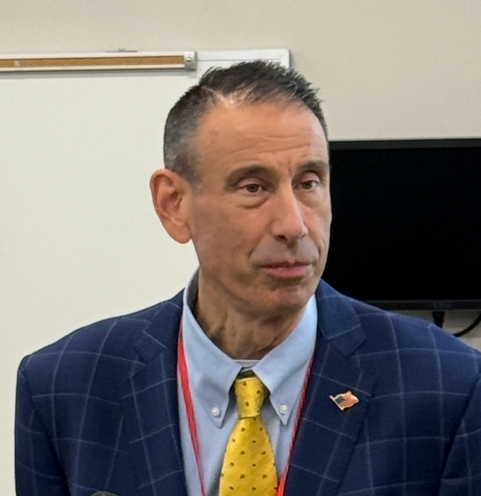

CEO, President and Chairman Joseph Otting, a former Comptroller of the Currency, said the majority of those in the sold operations “will be offered the opportunity to transfer to the buyer, facilitating a smooth transition and ensuring continued employment.”

Financial foundations

The company said the layoffs are part of “integrating its three legacy banks that were united through acquisitions” as it takes on a new name and identity.

Holding company New York Community Bancorp officially becomes Flagstar Financial on Oct. 25 at 5 p.m., before the New York Stock Exchange ticker on Oct. 28 goes from “NYCB” to “FLG.”

“We launched a transformation strategy earlier this year to drive change throughout the organization,” Otting said of what he called “right sizing” that includes “impacts on jobs” and cuts that he believes “are essential for strengthening our financial foundation and building a more agile, competitive company.”

He said “these reductions will not impact our service or progress,” noting “in many cases, roles were similar or duplicative.”

After decades of expansion, this is a huge shift at one of Long Island’s most historic banks that until 2020 had naming rights for the Nassau Coliseum as “NYCB Live: Home of the Nassau Veterans Memorial Coliseum.”

Flagstar as of March 31 reported $112.9 billion in assets, ranking No. 28 among American banks, according to U.S. News and World Report. Its significance, however, was always due to more than size. NYCB carved out a niche as a bank that grew by acquiring community banks – and refusing to rename them.

Singular Strategy

In a singular banking strategy designed to keep brands connected to communities, NYCB acted local, but thought national. It consolidated community banks, but kept their names such as Roslyn Savings Bank, Richmond County Savings Bank, Queens County Savings Bank, Roosevelt Savings Bank and Atlantic Bank in New York.

NYCB, and then Flagstar, also operated Garden State Community Bank in New Jersey, Ohio Savings Bank in Ohio, and AmTrust Bank in Arizona and Florida. That was one reason the NYCB name was never as well-known as it might have been: other names were writ large at branches, rebranded as Flagstar on Feb. 21 of this year.

NYCB’s history is one of a bank that started, and for a long time remained, small, until it went public and began buying others.

NYCB’s predecessor was founded in 1850 as Queens County Savings Bank, based in Flushing, Queens. Nearly 150 years later, it went public in 1993, changing its name to New York Community Bank in 2000, as it acquired other banks.

CEO Joseph Ficalora, who had started as a teller, for many years led the bank’s expansion from an office where he kept the stock market ticker visible from his desk. NYCB had a seemingly ravenous appetite for acquisition, consolidating community banks under its umbrella.

The company acquired Haven Bancorp for $196 million in 2000, Richmond County Financial for $802 million in 2001, Roslyn Bancorp for $1.6 billion in 2003, Long Island Financial for $69.8 million 2005 and Atlantic Bank of New York for $400 million in 2006. But that was just a start.

NYCB then acquired 11 New York City branches from Doral Financial in 2007, Penn Savings Bank for $262 million and Synergy Bank for $168 million both in 2007.

After the FDIC in 2009 took over troubled Ohio-based bank AmTrust, with $13 billion in assets, NYCBY acquired it. It in 2010 took over Desert Hills Bank, with $496 million assets, which also had been seized by the FDIC. And NYCB in 2012 acquired the assets of Aurora Bank from Lehman Brothers.

In December of 2020, President and CEO Joseph Ficalora announced he was retiring, if not ending an era, ending his reign at the helm of a company whose business model was built on buying banks as well as making loans.

Finding Flagstar

NYCB in 2022 acquired Flagstar Bank, adding $26 billion in assets and $24 billion in liabilities. The combination created what the company described as the second-largest multi-family portfolio lender in the country, and the leading multi-family portfolio lender in the New York City area, specializing in rent-regulated buildings.

The company described Flagstar Mortgage as the 7th largest bank originator of residential mortgages for the 12-months ending September 30, 2022, and the 5th largest sub-servicer of mortgage loans nationwide, servicing 1.4 million accounts with $360 billion in unpaid principal balances.

The combined company also said it was the second largest mortgage warehouse lender nationally based on total commitments.

Flagstar in 2023 acquired Signature Bridge Bank from the FDIC, adding $38 billion in assets and assuming $36 billion of liabilities, topping $100 billion in assets, triggering more rigorous regulation and reporting as a Category IV institution. That increased “requirements and expectations related to liquidity, risk management and governance,” according to Flagstar.

The bank all incurred roughly $259 million in costs related to the Signature transaction, primarily for legal, advisory, system conversion and other professional services.

Flagstar in SEC filings said as of 2023 its loans “began to experience stress, related principally to vacancy-driven declines in the office sector, and inflation and high interest rates in the multi-family sector.”

The company also cited the 2019 Housing Stability and Tenant Protection Act, including new rights for tenants and restrictions on landlords, as another factor.

“Concerns about the impact of these portfolio stresses led to significant declines in the company’s stock price and large customer deposit withdrawals in the first quarter of 2024,” according to an SEC filing.

Total deposits decreased by $2.5 billion to $79.0 billion as of June 30, 2024 compared to $81.5 billion on December 31, 2023.

The company in a filing said in February and March 2024, they lost $9.7 billion in customer deposits, “following downgrades in our debt and deposit ratings by third-party credit rating agencies.”

Moody’s Investors Services on Feb. 6, 2024 downgraded NYCB’s credit rating to junk, citing its exposure to commercial real estate lending troubles.

Fixing Flagstar

Flagstar in SEC filings said its commercial real estate loans are secured by income-producing properties such as office buildings, retail centers, mixed-use buildings, and multi-tenanted light industrial properties.

“Occupancy levels for office space have declined substantially over the past three years, which has had an impact on borrowers’ net operating income and their ability to cover debt service,” the company said. “These unfavorable market conditions also lower the value of underlying collateral which has had a material impact on loan charge-offs in 2024.”

Flagstar raised $1.05 billion in equity capital in March, 2024 by issuing preferred and common stock to investors such as Liberty Strategic Capital, led by Steven Mnuchin, U.S. Treasury Secretary under Donald Trump, and other investors.

Meanwhile, the company said “deposits stabilized for the remainder of the first quarter.” In the second quarter, Flagstar boosted deposits by $3 billion.

Still Flagstar has been swimming in a red sea even as it seeks to get its land legs back. The company reported a $323 million second quarter 2024 net loss compared to $327 million in the prior quarter.

While Flagstar has been seeking to get firm footing by cutting costs, Otting said it strengthened management and its Board, improving efficiency and enhancing credit oversight, as well as cutting jobs.

“We’ve diversified our business model, established relationship-driven businesses, and continue to recruit top-tier talent with expertise in advancing our vision,” he said of Flagstar. “Our new company name complements the re-branding of the bank and our branches we implemented earlier this year. This name change is a continuation of those efforts and unifies the company and our vision into a single brand.”