The U.S. housing market was in a state of flux in the first quarter of 2025. Sales of existing homes hit a 10-month high in January before dropping in February, only to rise again in March.

Home prices are increasing in most parts of the country, and mortgage rates have stayed between 6.5% and 7%, leading many homebuyers to postpone their purchase. During the first quarter of 2025, the median sales prices for residential properties in Nassau County increased year over year as follows:

- Single-Family Homes: Median sales price increased by 9.8% to $810,000

- Condos: Median sales price increased by 21.3% to $770,000

- Co-ops: Median sales price increased by 12.2% to $336,500

The average increase across these property types can be calculated as: (9.8% + 21.3% + 12.2%) / 3 = 14.4%

Thus, the average increase in median sales prices was approximately 14.4%, and the median increase was 12.2%.

Inventory has continued to grow nationwide, with the total number of homes for sale up considerably from the same period last year.

Buyer demand has softened within specific areas of the U.S., and properties are spending more time on the market as a result, forcing some sellers to slash prices as they adjust to changing market conditions.

Although housing costs are up nationally, price growth is moderating and with inventory at its highest level in years, buyers may face less competition and have more options in the months ahead.

The Housing Affordability Index in Nassau County decreased across all residential property types in Q1-2025 compared to Q1-2024:

- Single-Family Homes: Dropped by 8.8% from 80 to 73.

- Condos: Dropped by 17.2% from 93 to 77.

- Co-ops: Dropped by 10.7% from 197 to 176.

This indicates that housing affordability worsened in Q1-2025, with buyers needing a higher percentage of their income to qualify for median-priced homes under prevailing interest rates.

Inventory has continued to grow nationwide, with the total number of homes for sale up considerably from the same period last year.

Buyer demand has softened slightly, and properties are spending more time on the market as a result, forcing some sellers in many areas to slash prices (not necessarily in Long Island) as they adjust to changing market conditions. Although housing costs are up nationally, price growth is moderating, and inventory has been at its highest level in years.

From my observations over the last few years, real estate sales in the vast majority of states, cities, and towns are basically determined first by interest rates.

However, other pertinent variables that are affected by those rates are the amount of inventory, whether increasing or decreasing, the local economy, existing jobs, and what I call the fear factor, which keeps buyers on the sidelines and causes FOMO (fear of missing out) for those who can afford to purchase.

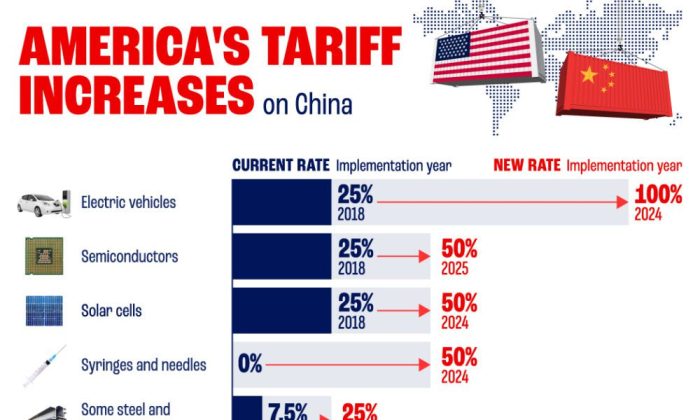

I believe the tariffs that have been imposed across the board, then paused, then on again, as I converse and have discussions with many people, are causing a fear factor.

People (as well as small and large businesses) cannot consistently plan their course of action and what will happen in the short and long term for consumers and the business environment.

The current flip-flopping of the switch-on and switch-off decisions to raise, pause, and eliminate tariffs is an extremely confusing factor that the majority cannot see clearly and consistently in determining future planning.

We have literally pissed off and negated the trust and credibility of our long term allies.

We have set in motion a dire and no turning back situation that may never resolve itself with respect to having trusting trade partners ever again. China is wooing those countries directly, which, unless something changes with respect to our tariffs, will be a losing battle for the U.S.

Come back next week for Part 2

Philip A. Raices is the owner/broker of Turn Key Real Estate, located at 3 Grace Ave, Suite 180 in Great Neck.

For a free 15-minute consultation, value analysis of your home, or to answer any of your questions or concerns, he can be reached

by cell: (516) 647-4289 or by email: Phil@TurnKeyRealEstate.Com and you can search properties at your leisure and convenience at:

bit.ly/4bXWVu6 (facebook.com)

bit.ly/4inVqaR (X.com)

bit.ly/4bVSwrs (linkedIn)

bit.ly/4inVK9z (Instagram)

bit.ly/4bQH14x (YouTube)