If you haven’t read Part 1 from last week, go to LongIslandPress.com. Click on News, then scroll down to the real estate link.

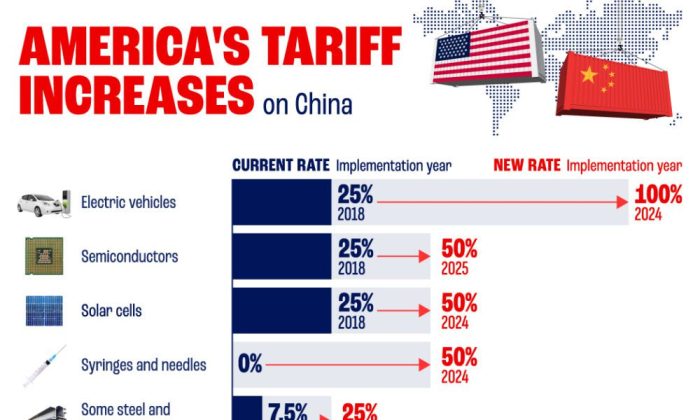

Real Estate will be affected as prices rise for consumer staples, goods and services. Consumers may not truly understand that as companies raise their prices to stay in the black and continue to be profitable, we will pay the price of those increased costs.

Essentially, we will pay for those tariffs and not the countries against which we have levied them. This will eventually cause real estate inventory to rise as most pull back to the costs of ownership and will jump back on the fence and wait and see what happens.

These tariffs aim to bring back and repatriate jobs and businesses to the U.S., but that will never occur on a mass scale.

However, the billions gained will be offset by greater losses due to reduced consumer purchases, a decrease in sales taxes received locally and nationally, and less discretionary spending.

The pressure on increased consumer costs will have a detrimental effect on our economy. About half of our annual imports, $1.3 trillion, come from China, Canada, and Mexico. (Go to usfunds.com for a greater explanation of the impact of the tariffs on our imports).

Only those foreign corporations that will benefit from bringing their businesses here to avoid the tariffs and be competitive will consider doing so. The number one reason we outsource our manufacturing is the cost of labor, as we cannot compete with the wages in third-world countries.

If we tried to, manufacturing businesses would not survive and there would be no benefit in attempting to go into business if the risks and costs made no sense in the brain and cents in the pocketbook. As noted in last week’s column, our average wage is $30 per hour, and theirs is $7 per hour, and even less in some countries.

Could AI bring manufacturing back to the U.S.? It all depends on how it is used to create a profitable enterprise.

If you do your research, you will surmise that tariffs accounted for 50-90% of our federal revenue from 1798-1913.

Since the 1930s, we have moved from tariffs to free trade, as the local and federal income tax system was created and has become the prime method of funding our government.

Over the last 70 years, our tariffs have contributed to less than 2% of federal revenue. With the advent of the General Agreement on Tariffs and Trade and its successor, the World Trade Organization, global tariffs have dramatically lowered.

Prior to the current tariffs, 70% of imports were duty-free. In 2024, for example, U.S. Customs and Border Protection received $77 billion in tariffs, just 1.57% of total government income. We were the major player in manufacturing almost everything back then.

As our economy grew, wages increased. Other third-world countries also grew, but not at our pace, and their wages and standard of living were considerably lower.

The U.S. consumer is the largest purchaser of goods and services globally. We should impose tariffs on countries like China, which controls its currency and has outlawed Bitcoin, making its goods less expensive and creating greater demand.

Competition is healthy, but when it is unfair and fixed, it undercuts us, causing our national and international debt and trade deficits to soar, as we buy more goods and services than we sell overseas.

Last year, we had a $1.2 trillion trade deficit! We are at a pivotal and uncertain time that we may be unable to turn back from and/or repair.

Come back next week for the final Part 3

Philip A. Raices is the owner/Broker of Turn Key Real Estate, located at 3 Grace Ave., Suite 180 in Great Neck. For a free 15-minute consultation, value analysis of your home, or to answer any of your questions or concerns, he can be reached by cell: (516) 647-4289 or by email: Phil@TurnKeyRealEstate.Com and you can search properties at your leisure and convenience at:

bit.ly/4bXWVu6 (facebook.com)

bit.ly/4inVqaR (X.com)

bit.ly/4bVSwrs (linkedIn)

bit.ly/4inVK9z (Instagram)

bit.ly/4bQH14x (YouTube)